In a complex and uncertain market context like the current one, it is interesting to observe the recent developments in the Electronics Manufacturing Services (EMS) sector.

What is happening and what are the medium-term prospects for this sector?

During the latest market meeting organized by Assodel (The Italian Association of Electronics Districts), Debora Ianni, Vice President of Marketing & Sales at Tecno System, responded to this question by providing an overview of the electronic board production sector.

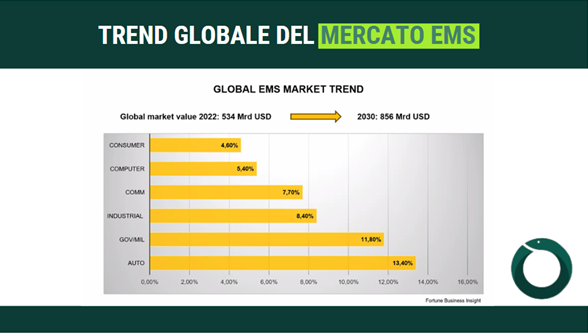

Growth forecasts for EMS until 2030

In line with the trends in the semiconductor and electronic components market, the EMS market is also experiencing a period of slowdown.

Future prospects, however, remain positive. According to analysts, the electronic board production sector will see significant global growth in the coming years, with a forecast to reach a market value of $856 billion by 2030 (Figure 1).

Which sectors will drive this growth?

The Automotive sector will show double-digit growth, mainly driven by the market for hybrid and electric vehicles, generating increased demand for control systems and power systems. This is in line with the pronounced push towards sustainable mobility models and the need for charging infrastructure.

The Military and Government sectors are also experiencing growth, driven by funding for digital and ecological transition and the National Recovery and Resilience Plan (PNRR). Among these, there is an acceleration in the Railway sector, thanks to investments in infrastructure and networks at the European level.

The Industrial sector appears somewhat more cautious compared to others, but the trend is still growing due to the digitalization process and the push towards Industry 4.0 and interconnected factories.

Other relevant sectors include Telecommunications, data collection, Computing, and the Consumer sector.

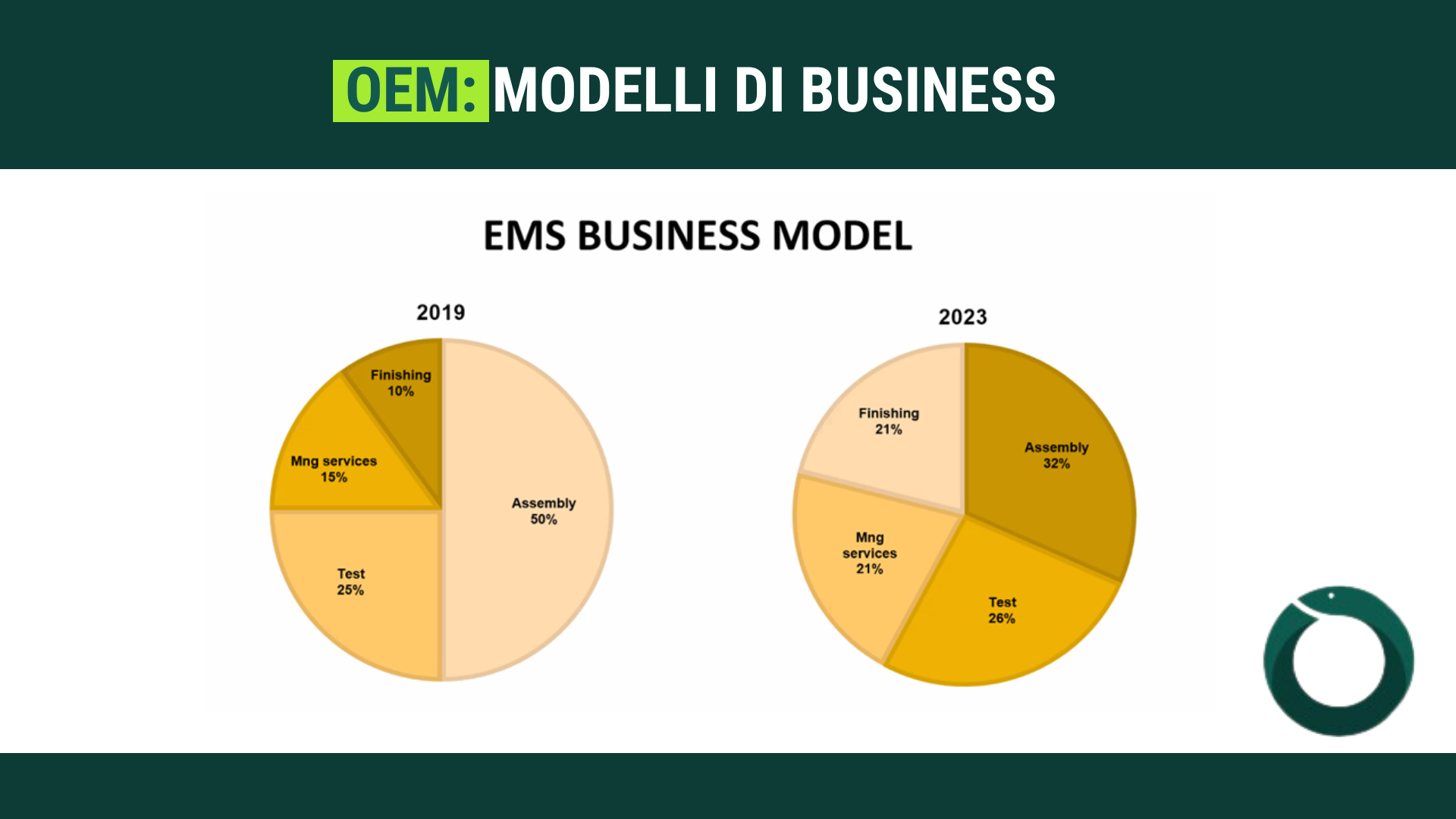

How business models are changing

In recent years, something has changed.

Compared to the pre-pandemic period, significant evolutions have been observed in the business models of OEMs and their relationship with EMS partners. Until 2019, OEM customers primarily demanded Assembly and Test services, paying less attention to Finishing activities and additional services such as supply chain management, reworking, and repairs. However, after the pandemic, a shift in priorities occurred, with increased demand for Services and Finishing. OEMs are increasingly outsourcing services that they previously managed internally.

Consequently, EMS providers are assuming an increasingly strategic role in supporting their clients, offering not only traditional activities but also support for processes and production localization.

Furthermore, there is a growing trend among customers to expand internationally, with many companies choosing not to have all production in Italy but to move part of their production and processes to other parts of the world.

For example, the “Make in India” (*) program has brought several requests from customers to produce locally in India. Tecno System has a production facility in Bangalore, specializing in products for the railway market, precisely to meet the growing demand for local production imposed by the Indian government.

*With the Make in India initiative, the local government has mandated that for participation in bidding for public works contracts, production ranging from 50% to 80% must be carried out on Indian soil.